Demonetization’s short term effects are playing out in the economy as India makes the adjustments to sudden withdrawal of 86% of currency in circulation. This is certainly not the first time that demonetization has been tried here. In 1946, all 1,000 and 10,000 rupee notes were recalled. In 1978, 1,000, 5,000, and 10,000 rupee notes were demonetized.

There has doubtless been a lot of negative impact on employment, especially in the unorganized sector. So will this impact persist? The short answer is yes. Crisis of employment opportunities will arise in the near future in India. If we take into account the Indian economy we know that it is cash based economy reason being cash transactions are far more than the total number of electronic transactions (14% in 2015) done on a daily basis.The unorganized sector, which dominates the economy will fill the pinch much harder than the organized sector.

In my opinion, employment growth will be frozen and in fact there will be job losses over the next 6-12 months as the painful adjustment happens. The use of unorganized and contract labour is a reality in India, even among the very large corporates and MNCs. In the face of demand and cash crunch, these businesses will not hesitate to lay off part of their work force, the damaging effects of which will be felt for as long as 24 months.

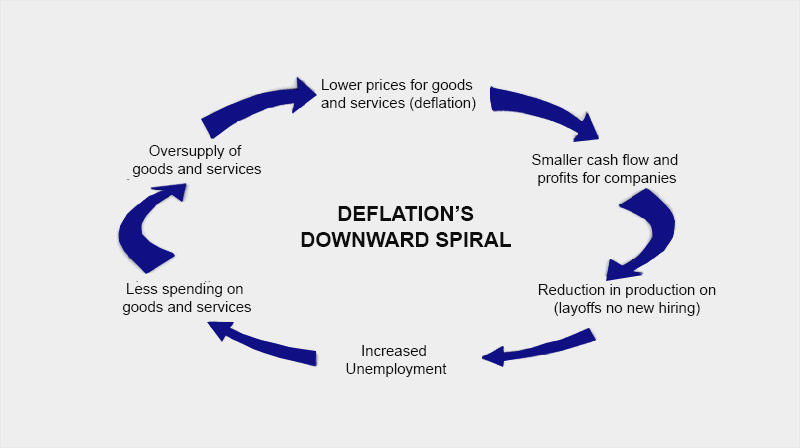

Another negative impact is that when a large amount of cash goes out of the system due to demonetization, the supply of money would reduce causing the prices of goods and commodities to fall leading to deflation.

This deflation would lead to further loss of demand as people continuously wait for prices to fall further and this in turn will lead to more job losses. Former chief statistician of India Pronab Sen said “If I am not going to able to sell, I am not going to buy from my supplier which will kick start a chain reaction. So even if the first round impact of lower money circulation may not have a large impact, the chain effect will be large,” he added.

According to Labour Bureau data released in April 2016, textiles, leather, metals, automobiles, gems and jewellery, transport, information technology and the handloom sectors together created 135,000 jobs during 2015. This is 67% lower than 421,000 jobs that were added in 2014.Unemployment rate in India has shot up to a five-year high of 5% in 2015-16 with the figure significantly higher at 8.7% for women as compared to 4.3% for men, says report by Labour Bureau.

It is those who are in the low income groups (deprived) who are the most affected by this decision. The daily wage workers, maids, farmers, local vendors, porters etc.

Remonetization efforts are clearly falling behind the demand for cash and this means that demand and job revival will be difficult. A near total liquidity squeeze on the purchasing power of people extending into Q4 will lead to a slowdown in sales of every product and service. Besides people will get used to getting by with less and this may translate into a habit.

Some silver lining though will appear:

The turnover of the parallel economy part of which will merge into mainstream economy will keep stock markets buoyant and increase potential future sales of products and services.

Prof (Dr.) Mamta Gaur is Faculty In-charge, Faculty of Management Science at SRMS CET, Bareilly